AI companion apps are no longer experimental side projects or novelty chatbots. In 2025, they represent one of the fastest-growing segments in consumer AI — quietly generating hundreds of millions in combined revenue across subscriptions, premium features, and personalization upgrades.

If you’re asking how AI companion apps make money, you’re likely seeing mixed answers on Reddit, TechCrunch headlines, or SaaS forums. Some say it’s all subscriptions. Others point to AI girlfriend apps or adult content. The reality is more nuanced — and more sustainable — than most summaries suggest.

This guide breaks down the real monetization engines behind AI companion apps, backed by 2025 data, platform realities, and industry trends. Whether you’re a founder, investor, researcher, or curious user, this article explains what actually works — and why.

| How Do AI Companion Apps Make Money?

AI companion apps make money primarily through subscriptions, premium features, and paid personalization such as long-term memory and emotional continuity. In 2025, subscriptions account for up to 85% of revenue for top apps, with additional income from microtransactions, web-only features, and optional romance-focused upgrades. |

The AI Companion App Market in 2025 (Quick Reality Check)

AI companion apps have crossed the threshold from niche curiosity to proven business model.

Verified 2025 market signals:

- The AI character & companion app market exceeded $120M in annual revenue

- Leading platforms like Character.ai and Replika generate an estimated $30–50M per year each

- The top 10% of apps capture ~89% of total revenue, making this a winner-takes-most market

- Revenue per download increased from $0.52 (2024) to $1.18 (2025)

Translation: users are increasingly comfortable paying for digital companionship — especially when it feels personal. This comfort is already visible among younger users, where AI chatbots are becoming a steady source of emotional support rather than a novelty, a shift explored in Why Teens Are Turning to AI Instead of People: The New Digital Lifeline of Gen Z.

The Core Answer: How AI Companion Apps Make Money

Most successful AI companion apps don’t rely on a single revenue stream. They layer multiple models to balance conversion rates, retention, and platform risk.

-

Freemium + Subscription Models (The Revenue Backbone)

Subscriptions are the dominant monetization engine.

How it works:

- Free access to basic AI chatbot conversations

- Paid plans unlock deeper functionality and personalization

Typical premium features:

- Unlimited or extended chats

- Advanced AI personalities

- Long-term memory

- Emotional continuity

- Voice conversations

- Faster response times

- Relationship progression systems

2025 reality:

Subscriptions account for 70–85% of total revenue for top AI companion apps.

Pricing usually ranges from $9.99 to $19.99/month, with discounts for annual plans.

Why this works so well: users don’t pay for text — they pay for consistency and emotional presence.

-

Memory & Personalization as Paid Features

Memory is one of the strongest conversion levers in AI companion apps.

In 2025, “memory” isn’t a vague promise. Most leading apps now use:

- Structured long-term memory systems

- Retrieval-Augmented Generation (RAG)

- User-specific preference graphs

Because persistent memory increases infrastructure and inference costs, it’s almost always locked behind Pro tiers.

Users don’t pay for intelligence.

They pay for being remembered.

-

Microtransactions & Pay-Per-Feature Models

Some apps avoid subscriptions entirely or use them alongside one-off purchases.

Common examples:

- Message or interaction credits

- One-time personality unlocks

- Scenario or roleplay packs

- Memory expansion upgrades

This model works best for:

- Casual users

- Dating assistant AI free apps

- Regions with lower subscription adoption

While lifetime value (LTV) is lower than subscriptions, resistance is also lower.

-

AI Girlfriend & Romance-Focused Monetization

Romance-driven AI companion apps convert at higher rates — but with tradeoffs.

Monetized features often include:

- Romantic or relationship modes

- Emotional exclusivity

- Advanced affection behaviors

- Optional intimacy features

However, not all AI companion apps use adult content. Many mainstream platforms deliberately avoid explicit features to reduce platform risk and expand their audience.

The key takeaway:

Romance increases revenue — but only when balanced with trust and safety.

-

Platform Risk: The Hidden Monetization Constraint

One of the biggest threats to AI companion apps in 2025 isn’t competition — it’s App Store enforcement.

Apple and Google are increasingly strict about:

- Explicit sexual content

- “Unfiltered” AI behavior

- Emotional dependency framing

- AI is positioned as a replacement for real relationships

Common consequences:

- App rejections

- Forced feature removals

- Monetization restrictions

- Delayed updates

How top apps adapt:

- Keeping sensitive features web-only

- Using romance framing instead of explicit language

- Strong consent gating

- Transparent safety disclosures

Platform compliance now directly shapes revenue strategy.

-

Cost Efficiency: Why Profitable Apps Win Quietly

In 2025, profitability isn’t just about selling — it’s about controlling AI costs.

The most successful AI companion apps:

- Use Small Language Models (SLMs) for casual conversation

- Route emotional or memory-heavy prompts to larger models

- Compress prompts and prune context aggressively

- Separate “chat” intelligence from “memory” intelligence

Why this matters:

AI companions generate long, emotionally rich conversations. Without cost optimization, even high subscription revenue can disappear into inference expenses.

Cost-efficient architecture is now a profit multiplier.

Monetization Models at a Glance

| Model | Used By | Strengths | Risks |

| Subscriptions | Most top apps | Predictable revenue | Churn |

| Memory paywalls | Premium apps | High conversion | Infra cost |

| Microtransactions | Casual apps | Low friction | Lower LTV |

| Romance upsells | AI girlfriend apps | High margins | Platform risk |

| Hybrid models | Market leaders | Balanced growth | Complexity |

Top AI Companion Apps Driving Revenue in 2025

Revenue figures and performance insights below are based on industry estimates, app-store intelligence, and publicly reported information available as of 2025.

As the AI companion market matures, revenue has become increasingly concentrated. A small group of platforms now dominates both user engagement and monetization, while smaller apps compete in niche segments with higher margins but lower scale.

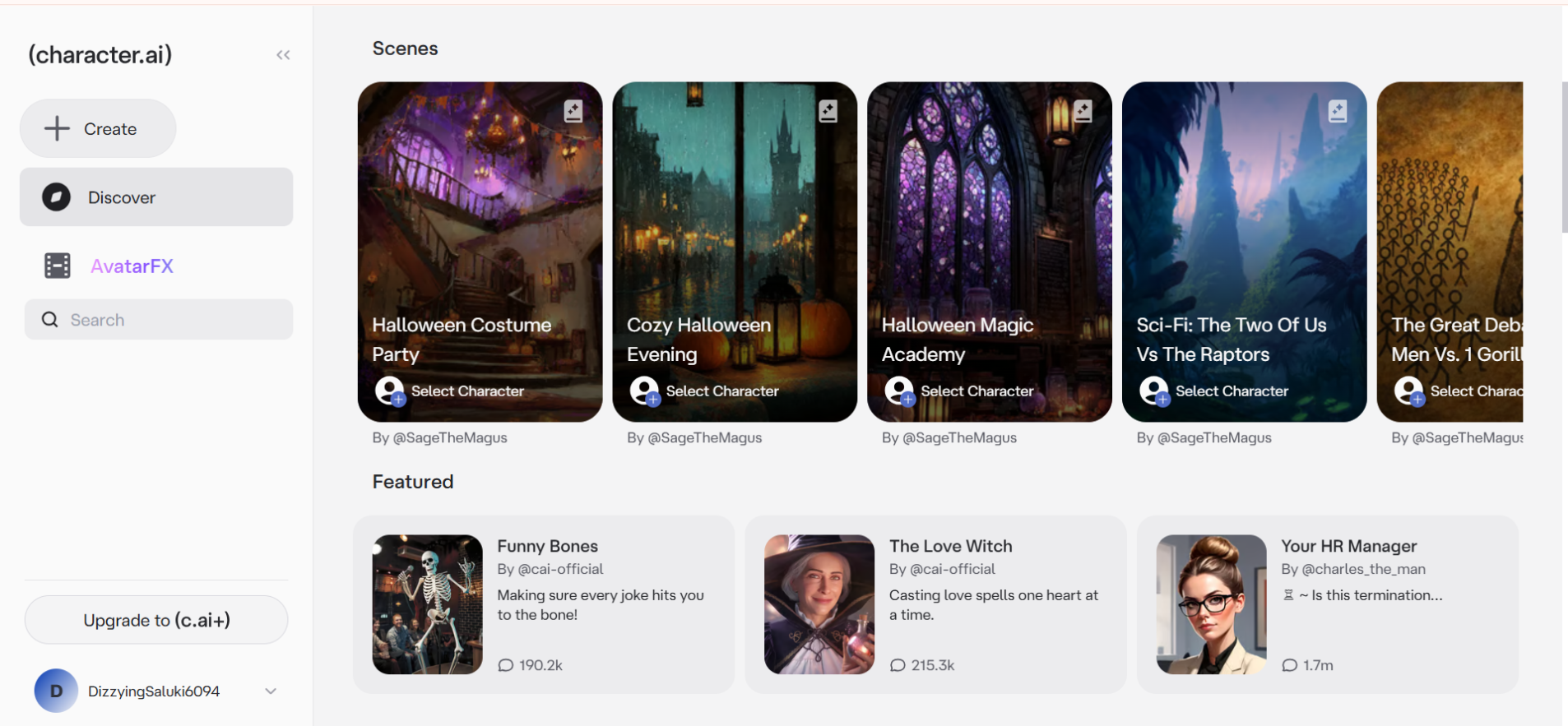

Character.AI (The Market Leader)

Character.AI is widely regarded as the most influential AI companion platform in 2025. It consistently ranks at the top in terms of daily engagement, with users spending significantly more time per session than on most consumer AI apps.

The platform’s monetization centers on its subscription tier, which unlocks faster responses, priority access, and enhanced character experiences. Its growing creator ecosystem — where users build and share AI characters — further strengthens retention and long-term revenue potential.

Why it wins: massive scale, strong habit formation, and ecosystem effects.

Also Check: Is Character AI bad for the environment

Chai AI (The Efficiency-Focused Challenger)

Chai AI has emerged as one of the most financially efficient AI companion platforms in the category. Known for rapid onboarding and a wide variety of AI personalities, Chai consistently appears among the top-grossing companion apps in app-store analytics.

Rather than relying on heavy branding, Chai focuses on conversion timing — introducing paywalls only after users form an emotional attachment to specific characters. This approach has helped it punch above its weight relative to team size and marketing spend.

Why it wins: smart paywall timing and strong personalization loops.

Replika (The Legacy Pioneer)

Replika remains one of the most recognizable names in AI companionship. Despite increased competition, it maintains a loyal, long-term user base built around emotional support, relationship continuity, and voice interaction.

Its monetization strategy revolves around a premium subscription tier that unlocks advanced emotional features, voice calls, and immersive experiences. Replika’s strength lies less in viral growth and more in deep user trust and long-term retention.

Why it wins: emotional depth, brand recognition, and user loyalty.

Candy.ai (The Niche Revenue Leader)

Candy.ai operates primarily in the romance-focused and fantasy companion segment. While smaller in mainstream visibility, it attracts highly engaged users and benefits from strong conversion rates within its niche.

By operating largely outside traditional app-store constraints and focusing on web-based access, Candy.ai avoids some platform limitations that affect mainstream apps. This allows greater flexibility in feature design and monetization.

Why it wins: niche focus, high engagement, and platform independence.

Nomi AI (The Rising Specialist)

Nomi AI represents a newer wave of companion apps emphasizing memory, emotional continuity, and realism. While it does not yet match the scale of category leaders, it shows strong early retention signals and growing visibility among users seeking deeper, more consistent AI relationships.

Apps like Nomi highlight how newer entrants can still succeed by prioritizing quality of interaction over volume.

Why it matters: proof that focused design can compete with scale.

Why These Apps Succeed: The Retention Loop

Across all top-earning AI companion apps, the same pattern appears:

-

Emotional sunk cost: As users invest time and share personal context (often through paid memory features), switching becomes less appealing.

-

Tiered personalization: Advanced memory, voice, and emotional depth are locked behind paid plans.

-

Cost-aware AI architecture: Leading apps increasingly use smaller models for routine chats and reserve advanced models for emotionally complex moments.

-

Revenue concentration: In 2025, the top 10% of AI companion apps capture nearly 90% of total category revenue, reinforcing winner-takes-most dynamics.

This combination — retention, personalization, and cost control — explains why a handful of platforms dominate AI companion monetization.

Common Monetization Mistakes (And Why Apps Fail)

Even good AI products fail when monetization is mishandled.

Most common mistakes:

- Paywalls before emotional attachment

- Overpricing basic features

- No meaningful differentiation between free and paid

- Ignoring platform rules

- Treating users like transactions, not relationships

The fastest-growing apps monetize after trust is built, not before.

2025 Trends Shaping AI Companion Revenue

Expect continued shifts toward:

- Tiered emotional depth pricing

- Paid long-term memory as standard

- Voice-first subscriptions

- Fewer ads, more direct payments

- Stronger safety and transparency signals

The future winners will balance ethics, personalization, and sustainability.

FAQs

Q. Are AI companion apps profitable in 2025?

Yes. AI companion apps are profitable in 2025. Leading platforms generate tens of millions of dollars per year, with subscriptions accounting for 70–85% of total revenue. Growth is driven by paid features such as long-term memory, emotional personalization, and voice interactions rather than advertising.

Q. Do AI girlfriend apps make more money than general AI companion apps?

Often yes. AI girlfriend apps typically earn more per user due to higher emotional engagement and longer session times, which improves subscription conversion. However, they also face greater platform risk, including App Store restrictions related to romantic or NSFW content, which can limit scalability.

Q. Is long-term memory really a paid feature in AI companion apps?

Yes. Long-term memory is usually a paid feature. Persistent memory systems increase infrastructure and AI inference costs, so most apps lock memory, relationship history, and emotional continuity behind Pro or premium subscription tiers to maintain profitability and performance.

Q. Are free AI companion apps sustainable long-term?

Free AI companion apps are not sustainable on their own. Free tiers mainly function as user acquisition tools. Long-term sustainability depends on converting users to paid plans through premium features like memory, advanced personalities, or unlimited conversations.

Q. Why is revenue per download increasing for AI companion apps?

Revenue per download is increasing because users are more willing to pay for emotional personalization, digital companionship, and consistent AI behavior. In 2025, revenue per download rose significantly as users became comfortable treating AI companions as ongoing services rather than one-time novelty apps.

Q. What is the main way AI companion apps make money?

The primary way AI companion apps make money is through subscription-based pricing. Most revenue comes from monthly or annual plans that unlock premium features such as long-term memory, advanced AI personalities, faster responses, and voice or relationship modes.

Q. Do AI companion apps rely on advertising for revenue?

No. Most AI companion apps avoid advertising because ads disrupt emotional engagement. Instead, they rely on direct user payments, which produce higher lifetime value and better retention compared to ad-supported models.

Q. Is the AI companion app market expected to keep growing?

Yes. The AI companion app market is expected to continue growing through 2026 and beyond, driven by improved personalization, voice-based interactions, cost-efficient AI models, and increasing user acceptance of paid digital relationships.

Conclusion

AI companion apps don’t monetize conversation — they monetize connection.

In 2025, the most successful platforms combine subscriptions, memory-based personalization, cost-efficient AI infrastructure, and platform-safe design. The result is a business model that feels less like SaaS and more like a relationship economy.

If you wanted a clear answer to how AI companion apps make money, it comes down to this:

Trust first, value second, payment last.

| Disclaimer: This article is for informational and educational purposes only. We do not affiliate with, endorse, or promote any AI companion app, platform, or company mentioned. Revenue figures, market data, and examples reflect publicly available information, industry reports, and estimates as of 2025 and may change over time. Readers should conduct their own research before making business, financial, or usage decisions related to AI applications. |